Congress Passes Bill to Raise the Debt Ceiling To Curb Defaulting

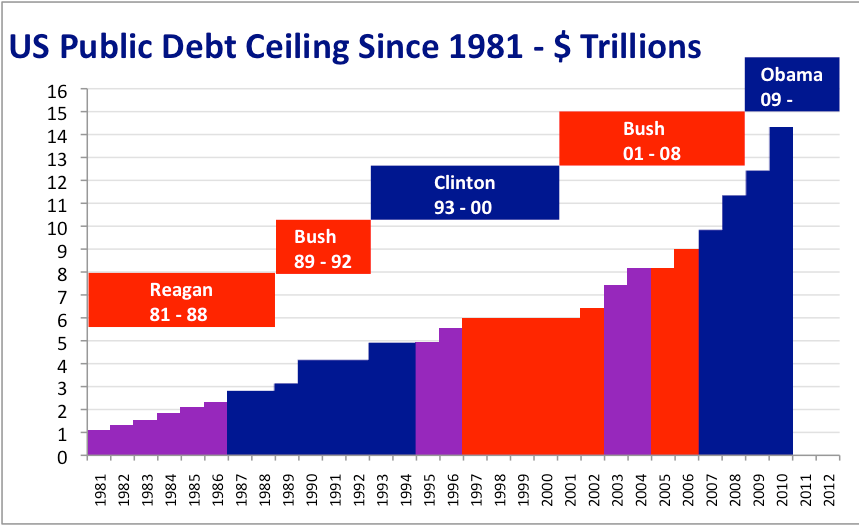

The debt ceiling has been constantly raised for decades. This chart shows the amount raised in trillions between the years 1981 and 2010.

The Grand Old Party (GOP) could’ve brought massive financial problems if they had not conformed.

The debt limit was set at 28.4 trillion dollars and was recently raised by 480 billion after a Republican filibuster was broken.

The debt ceiling, or debt limit, has been around for a long time, but has recently been the topic of discussion. Oct. 14, 2021 President Joe Biden signed into law the raising of the debt ceiling from 28.4 trillion dollars to 28.9 trillion dollars. The US has never defaulted on the limit, but if that were to ever happen it could cause catastrophic effects.

“The Second Liberty Bond Act of 1917 gave the Treasury much more flexibility in managing federal finances by not restricting the purpose for which new debt was issued.” The Bipartisan Policy Center said in an article on their website. Prior to the Second Liberty Bond Act of 1917, Congress authorized each individual case of issuing debt and gave tight parameters for the Treasury. During July 1939, Congress set the first federal debt limit at 45 billion dollars. This also gave the Treasury much more independence as long as they never exceeded the limit.

World War 2 caused the ceiling to be raised much more frequently due to the cost of the war. By the end, it was set at 275 billion dollars and remained that way for a period of time. The first case of a close call with the ceiling was in April of 1979 when the Treasury Department had a backlog of payments due that cost about 122 million dollars.

The debt ceiling was then increased to 2.1 billion dollars in December of 1985 and again in 2002 to 6.4 trillion dollars. After the debt limit had been suspended due to the No Pay Act of 2003, it was reinstituted at 16.7 trillion dollars. After multiple suspensions and raises, the debt ceiling was set at 28.4 trillion dollars in August of 2021.

In October of 2021, the Senate passed the bill to raise the limit from 28.4 trillion dollars to 28.9 trillion dollars. The final vote was 50 – 48 with Democrats fully on board and the majority of Republicans firmly against. Senator Mitch McConnell prevented a Republican filibuster after partly backing down on his stance towards raising the debt ceiling. He persuaded 11 Republicans to vote in favor of the bill. This was not cemented until the Senate voted, with some Republicans reluctant to drop their views until the very end.

The list of GOP Senators that voted in favor of the bill are Richard Shelby of Alabama, Lisa Murkowski of Alaska, Mitch McConnell of Kentucky, Susan Collins of Maine, Roy Blunt of Missouri, Rob Portman of Ohio, John Thune of South Dakota, Mike Rounds of South Dakota, John Cornyn of Texas, Shelby Moore Capito of West Virginia, and John Barrasso of Wyoming.

While the government has never defaulted on the debt limit, they were 11 days away from defaulting. This could create catastrophic financial effects, such as not receiving Social Security funds or Medicare benefits. Countless jobs would be lost, only essential federal employees could work, and troops and federal employees would stop receiving paychecks. These are all just scraping the top of what could happen, and those that are already at a disadvantage are going to suffer worse than others. They were set to default by October 18, but with the new limit they are set to default by Dec. 3, 2021.